84

26 TRUST STRUCTURE (CONTINUED)

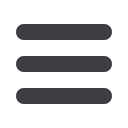

The jointly controlled entities assets and liabilities accounted for using equity accounting was:

Consolidated

2016

$'000

2015

$'000

Statement of financial position

Current assets

23,952

33,181

Non-current assets

85,754

76,935

Total assets

109,706

110,116

Current liabilities

9,980

23,569

Non-current liabilities

48,453

42,157

Total liabilities

58,433

65,726

Net assets

51,273

44,390

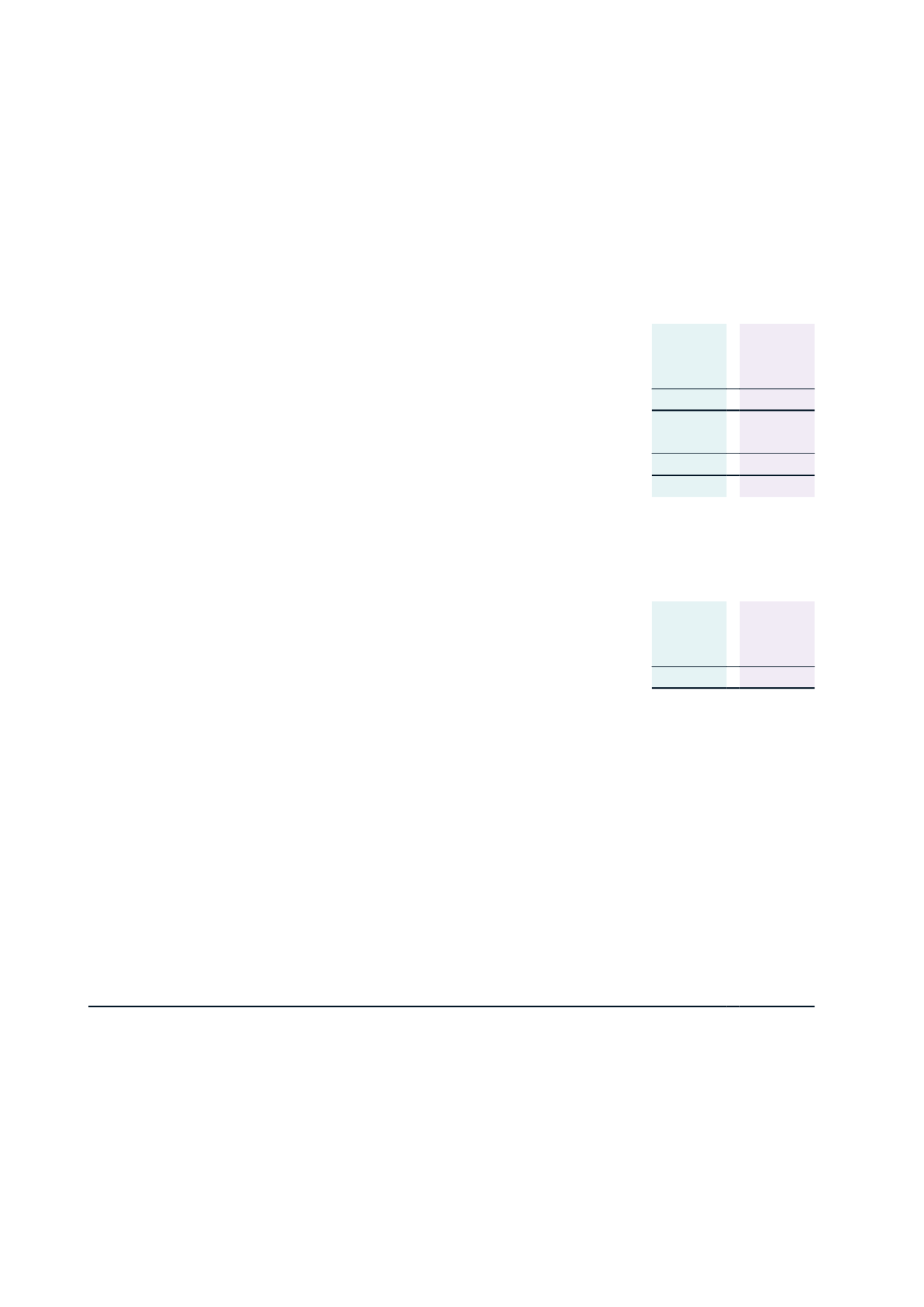

The jointly controlled entities revenue and expenses accounted for using equity accounting was:

Consolidated

2016

$'000

2015

$'000

Statement of comprehensive revenue and expense

Revenues

68,346

48,102

Expenses

(60,761)

(51,654)

Surplus before income tax

7,585

(3,552)

Recognition and measurement

Investments in joint ventures are classified as either jointly controlled assets, joint operations or jointly controlled entities

depending on the contractual rights and obligations of each investor. The Trust has assessed the nature of its joint ventures and

determined them to be jointly controlled entities. Jointly controlled entities are accounted for using the equity method.

Under equity method of accounting, interests in jointly controlled entities are initially recognised at cost and adjusted thereafter

to recognise the Trust’s share of the post-acquisition profits or losses and movements in other comprehensive revenue and

expense. When the Trust’s share of losses in jointly controlled entities equals or exceeds its interest in the jointly controlled

entity (which includes any long term interests that, in substance, form part of the Trust’s net investment in the jointly controlled

entity), the Trust does not recognise further losses, unless it has incurred obligations or made payments on behalf of the jointly

controlled entity.

Unrealised gains or transactions between the Trust and its jointly controlled entities are eliminated to the extent of the Trust’s

interest in the jointly controlled entity. Unrealised losses are also eliminated unless the transaction provides evidence of an

impairment of the assets transferred.

WAIKATO RAUPATU LANDS TRUST

Notes to the financial statements

FOR THE YEAR ENDED 31 MARCH 2016