83

Recognition and measurement

Subsidiaries are all entities (including special purpose entities) over which the Economic entity has the power to govern the

financial and operating policies, generally accompanying a shareholding of more than one half of the voting rights. The

existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing

whether the Economic entity controls another entity. Subsidiaries are fully consolidated from the date on which control is

transferred to the Economic entity. They are de consolidated from the date that control ceases.

Intercompany transactions, balances and unrealised gains on transactions between the Trust’s companies are eliminated.

Unrealised losses are also eliminated. Accounting policies of subsidiaries have been changed where necessary to ensure

consistency with the policies adopted by the Trust.

(b) Joint venture partnership

The Trust has interests in joint venture partnerships, which are all resident in New Zealand.

The interests in the joint venture partnerships are accounted for in the financial statements using equity method of accounting.

Information and the effect the joint venture interest had on the Trust’s financial statements is set out below.

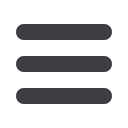

Joint venture

Principal activity

Ownership interest

Consolidated

Carrying value of investment

2016

2015

2016

$'000

2015

$'000

Callum Brae Tainui

Property

50%

50%

5

186

Ngai Tahu Tainui Go Bus Holdings Limited

Direct investment

33%

33% 25,701

24,240

Raukura Moana Sealord Limited Partnership

Primary Industries

50%

50%

435

336

Rotokauri Development Limited

Property

70%

70%

7,965

5,186

TAG Forestry Joint Venture

Primary Industries

50%

50%

515

436

Waikato Milking Systems Limited Partnership

Direct investment

32%

32% 16,652

14,006

51,273

44,390

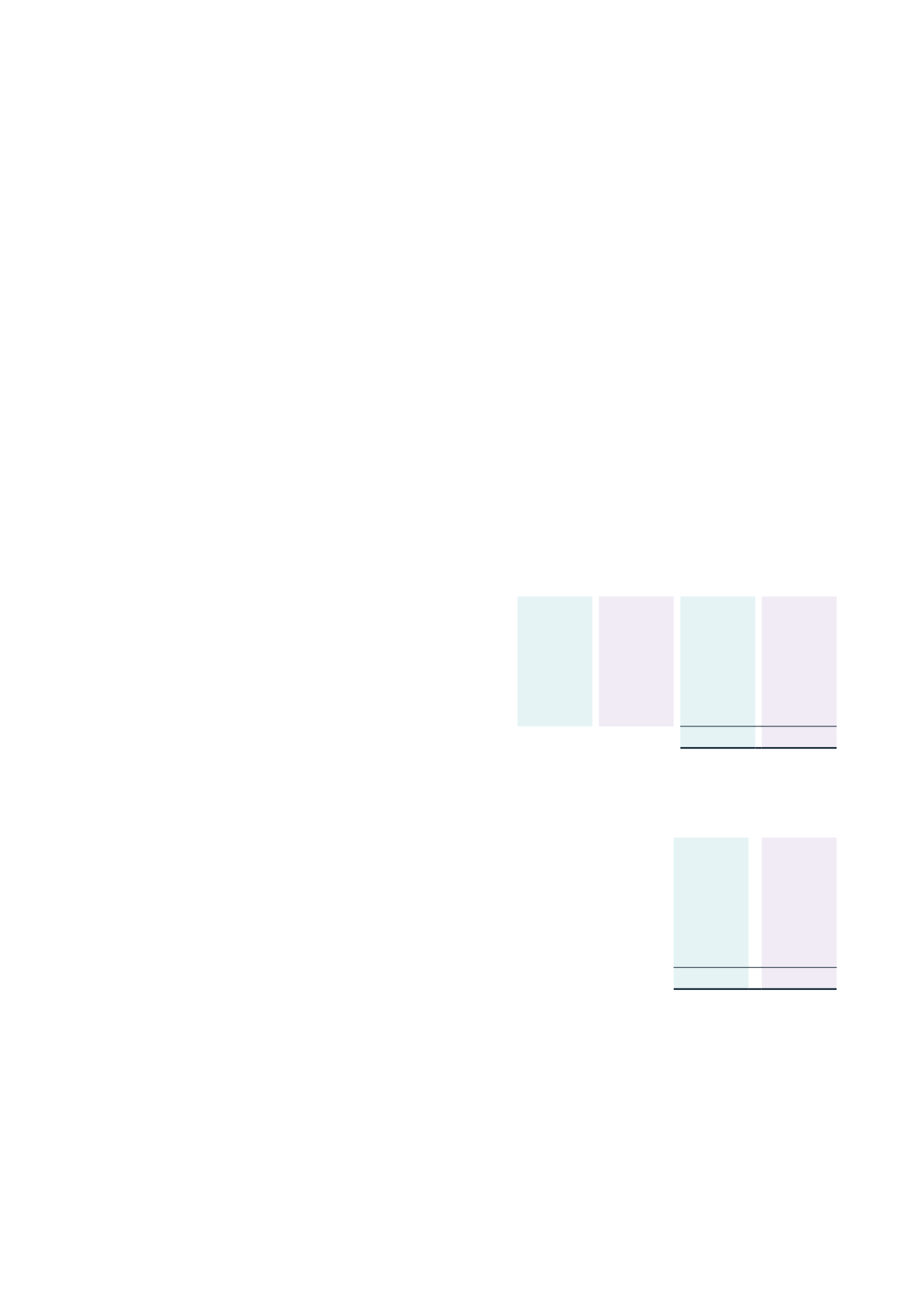

Consolidated

2016

$'000

2015

$'000

Movements in carrying amounts of the joint venture partnerships

Carrying value at the beginning of the year

44,390

22,189

Share of surplus/(deficits) after income tax

7,585

(3,552)

New investments

-

25,570

Contribution

1,824

2,356

Dividends received

(2,526)

(2,173)

Balance at 31 March

51,273

44,390