89

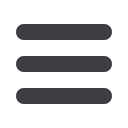

Financial liabilities as per statement of financial position

Liabilities at fair

value through

surplus or deficit

$'000

Liabilities at

amortised cost

$'000

Total

$'000

Consolidated

At 31 March 2016

Borrowings

-

250,352

250,352

Derivative financial instruments

10,735

-

10,735

Trade and other payables

-

10,497

10,497

10,735

260,849

271,584

At 31 March 2015

Borrowings

-

268,133

268,133

Derivative financial instruments

7,686

-

7,686

Trade and other payables

-

10,594

10,594

7,686

278,727

286,413

(f) Capital risk management

The Trust’s capital is its equity (comprised to retained earnings and reserves) plus its debt. Equity is represented by net assets. The

Trust is subject to the financial management and accountability provisions of the Charities Act 2005, Waikato Raupatu Claims

Settlement Act 1995 and the Waikato-Tainui Raupatu Claims (Waikato River) Settlement Act 2010. The Trust manages its revenues,

expenses, assets, liabilities, investments and general financial dealings prudently. The Trust’s equity is largely managed as a by-

product of managing revenues, expenses, assets, liabilities, investments and general financial dealings. The objective of managing

the Trust’s equity is to ensure the Trust effectively achieves its objectives and purpose, whilst remaining a going concern in order

to provide returns for the Waikato Raupatu Lands Trust and to maintain an optimal capital structure to reduce the cost of capital.

During 2015 the Trust (excluding the hotels) restructured its arrangements with all banks to align the debt facilities with relevant

Controlled entity entities that have contributed towards the debt. This has resulted in a cost effective structure which has led

to a number of assets being released from unnecessary security. The Trust debt reported is $250m (2015: $268m) (see note

19). The Trust has not breached any bank covenants as required by the ANZ, ASB Bank, Bank of New Zealand and Westpac

New Zealand Limited during the reporting period (see note 19) (2015: no breach). There are no externally imposed capital

requirements at balance date (2015: nil).

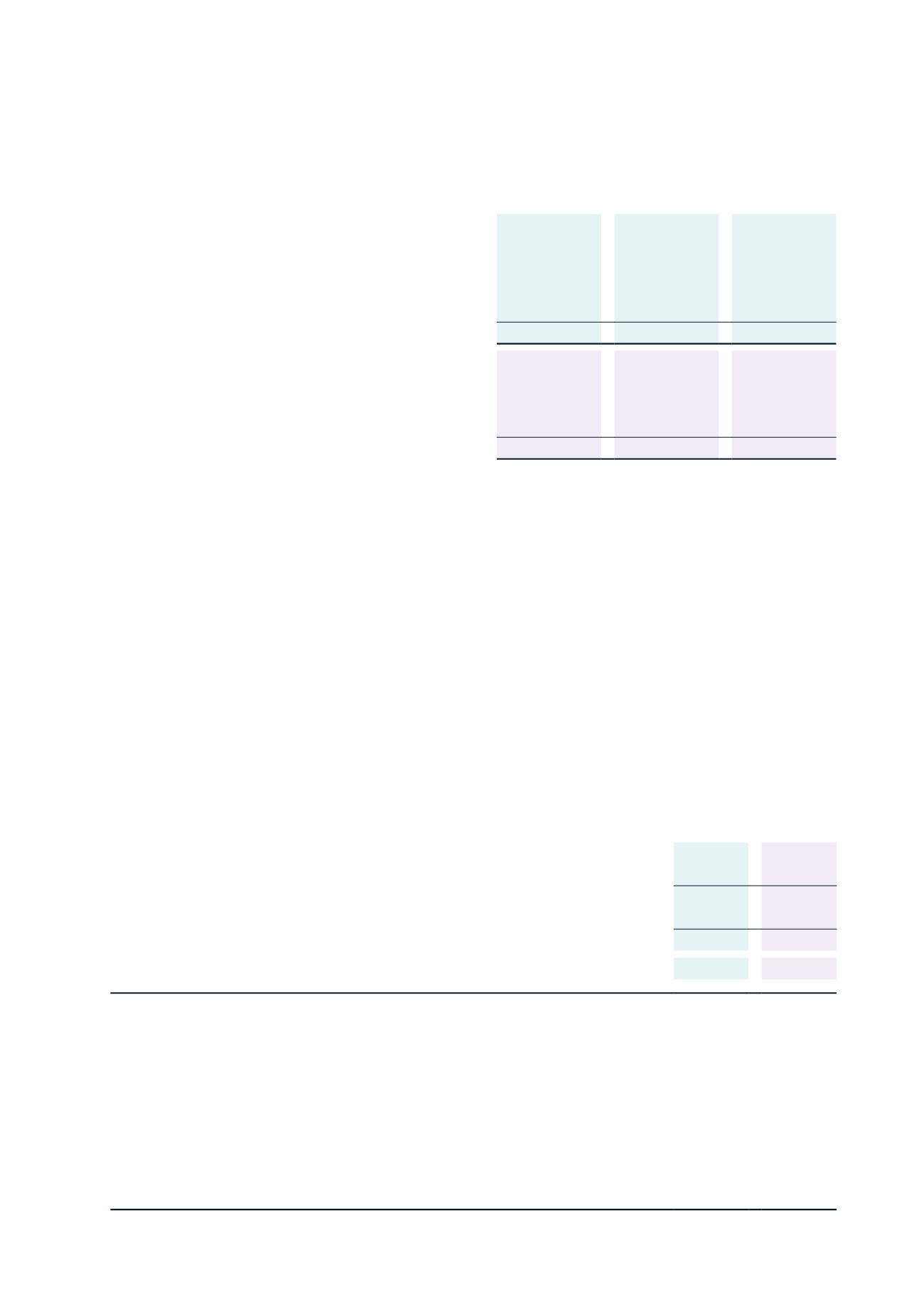

Consolidated

Note

2016

$'000

2015

$'000

Total borrowings

250,352

268,094

Less: cash and cash equivalents

20 (181,010)

(176,959)

Net debt

69,342

91,135

Total equity

939,882

861,561

Total capital

1,009,224

952,696

Gearing ratio

7%

10%

28 EVENTS OCCURRING AFTER THE BALANCE DATE

On 7 April 2016, the Trust entered into a new lease with TGHL for a 120 year period.

On 8 April 2016, Tainui Group Holdings Limited agreed to sell a 50 percent interest in The Base Limited to Kiwi Property

Holdings Limited for $192.5 million. Settlement occurred on 31 May 2016.

On 4 May 2016, the assets and liabilities of Hamilton Riverview Hotel Limited were sold into Hamilton Riverview Hotel Limited

Partnership. Tainui Group Holdings Limited continue to hold 100 percent ownership and voting interest in Hamilton Riverview

Hotel Limited Partnership.