79

The Base Limited has debt facilities of $203.5m (2015: $210m). The facilities include a multi option credit line facility agreement

with Westpac New Zealand for $67.8m (2015: $70m), a committed cash advance facility with Bank of New Zealand for

$67.8m (2015: $70m) and term loan facility agreement with ANZ for $67.8m (2015: $70m). All three facilities mature on 18

January 2020. Borrowings of $203.5m of the available facilities had been drawn at balance date (2015: $194.7m). ANZ, the

Bank of New Zealand and Westpac New Zealand have an equal charge over the present and future acquired assets of The Base

Limited as security for the finance facilities in 2016 and 2015.

The Base Limited’s debt facilities of $203.5m are classified as current liabilities at 31 March 2016, as it was deemed highly

probable that the Group would sell a 50 percent shareholding in The Base Limited. Any sale will require full repayment of the

debt facilities in order to discharge the security interest placed on the assets. Refer note 28.

Tainui Development Limited has established a committed cash advance facility with Bank of New Zealand for $25m which

matures on 24 December 2017 (2015: $25m). Borrowings of $5.6m had been drawn at balance date (2015: $24.7m). The Bank of

New Zealand has a charge over the present and future acquired assets of Tainui Development Limited as security for this finance

facility in 2016 and 2015.

Tainui Development Limited’s debt facility of $5.6m is also classified as current liability as the Group is expected to repay the

debt facility in full in the next 12 months.

Tainui Auckland Airport Hotel holds a Committed Cash Advance Facility with Westpac New Zealand for $28m (2015: $28m)

which matures 31 March 2019. Borrowings of $18.0m of the available facility had been drawn at balance date (2015: $20.9m).

Westpac New Zealand has a first and exclusive security agreement over the $28.8m assets and undertakings of Tainui Auckland

Airport Hotel LP and Tainui Auckland Airport Hotel GP Limited.

Hamilton Riverview Hotel Limited holds a term loan with the Bank of New Zealand for $24m which matures 27 May 2019.

Borrowings of $23.3m (2015: $23.3m) of the available facility had been drawn at balance date. The Bank of New Zealand holds a

first and preferential security interest over all property owned by Hamilton Riverview Hotel Limited.

Recognition and measurement

Interest bearing liabilities are initially recognised at fair value, net of transaction costs incurred. Interest bearing liabilities are

subsequently measured at amortised cost. Any difference between the proceeds (net of transaction costs) and the redemption

amount is recognised in the statement of comprehensive revenue and expense over the period of the borrowings using the

effective interest method.

Borrowings are classified as current liabilities unless the Trust has an unconditional right to defer settlement of the liability for at

least 12 months after the balance date.

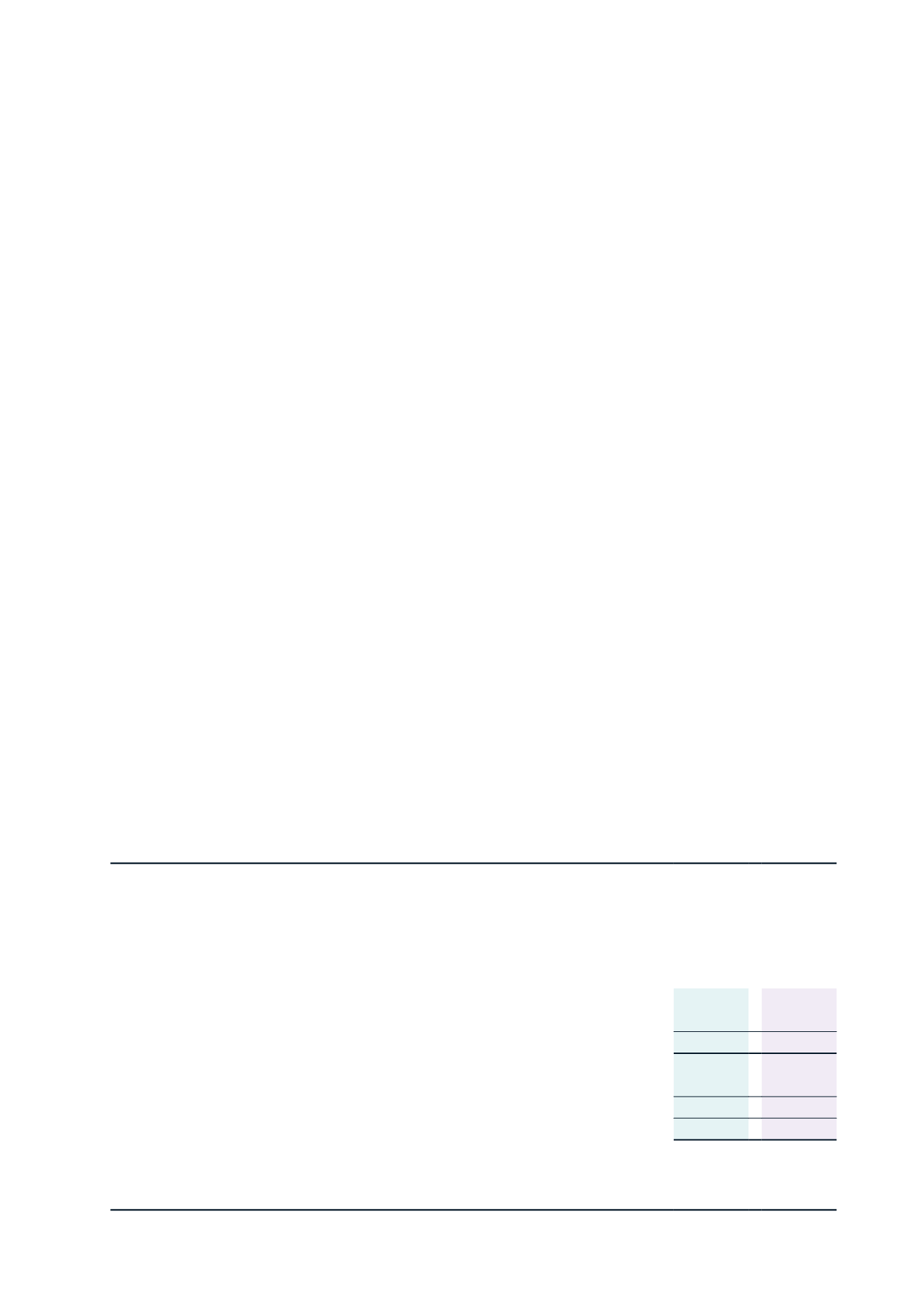

20 OTHER FINANCIAL LIABILITIES

Consolidated

2016

$'000

2015

$'000

Categorised as at fair value through surplus or deficit

Interest rate swaps

8,747

1,635

Total current other financial liabilities

8,747

1,635

Interest rate swaps

1,988

6,051

Total non-current other financial liabilities

1,988

6,051

10,735

7,686

The notional amount of interest rate swaps is $172.5m with maturity dates that range from 1-8 years (2015: $193m, maturing

between 1-8 years).