76

16 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

Land is not depreciated. Depreciation on other assets is calculated using the straight line method to allocate their cost or

revalued amounts, net of their residual values, over their estimated useful lives as follows:

Class of asset depreciated

Estimated useful life

Computers

2 - 10 years

Farm buildings

50 years

Hotels (buildings)

50 - 100 years

Hotels (other assets)

3 - 33 years

Office equipment, furniture and fittings

1 - 17 years

Other buildings

100 years

Plant and equipment

1 - 14 years

Vehicles

2 - 11 years

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance date.

Gains and losses on disposals are determined by comparing proceeds with carrying amount. These are included in the

statement of comprehensive revenue and expense. When revalued assets are sold, it is the Trust’s policy to transfer the amounts

included in revaluation reserves in respect of those assets to retained earnings.

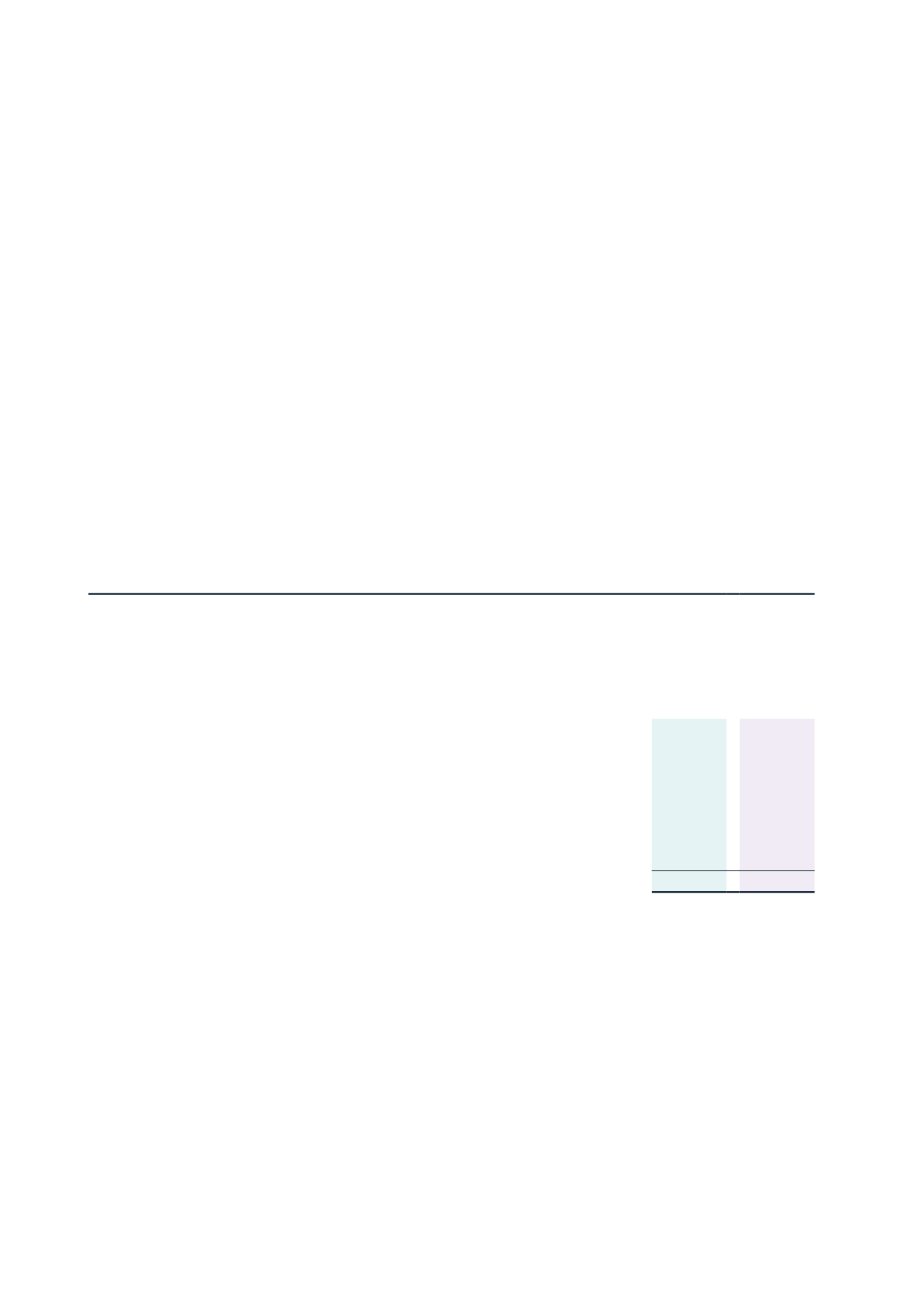

17 INVESTMENT PROPERTIES

Consolidated

Note

2016

$'000

2015

$'000

Balance at beginning of year

581,826

564,914

Development

2,014

13,078

Classified as held for sale or disposals

(180,456)

-

Net gain from fair value adjustment

5

30,365

8,007

Transfer to property, plant and equipment

16

(6,540)

(2,400)

Additions

-

-

Disposals

(20,208)

(1,773)

Balance at end of year

407,001

581,826

(a) Recognition and measurement

Investment properties include properties held to earn rental revenue, and/or for capital appreciation as well as investment

properties under construction. A property is also classified as an investment property if it does not have an operating lease in

place, but is held with the intention of attaining an operating lease.

Investment properties are initially recognised at cost, including transaction costs. Subsequent to initial recognition, investment

properties are carried at fair value, representing open market value determined annually by external valuers. Changes in fair

value are recorded in the statement of comprehensive revenue and expense.

(b) Valuation of investment properties

The significant methods and assumptions applied in estimating the fair value were:

• the direct comparison approach (based on analysis of sales of vacant property. This analysis includes determination of land

value, other improvements and residual value for principal improvements);

• the traditional capitalisation approach (focusing on the net maintainable revenue and the level of investment return);

WAIKATO RAUPATU LANDS TRUST

Notes to the financial statements

FOR THE YEAR ENDED 31 MARCH 2016