65

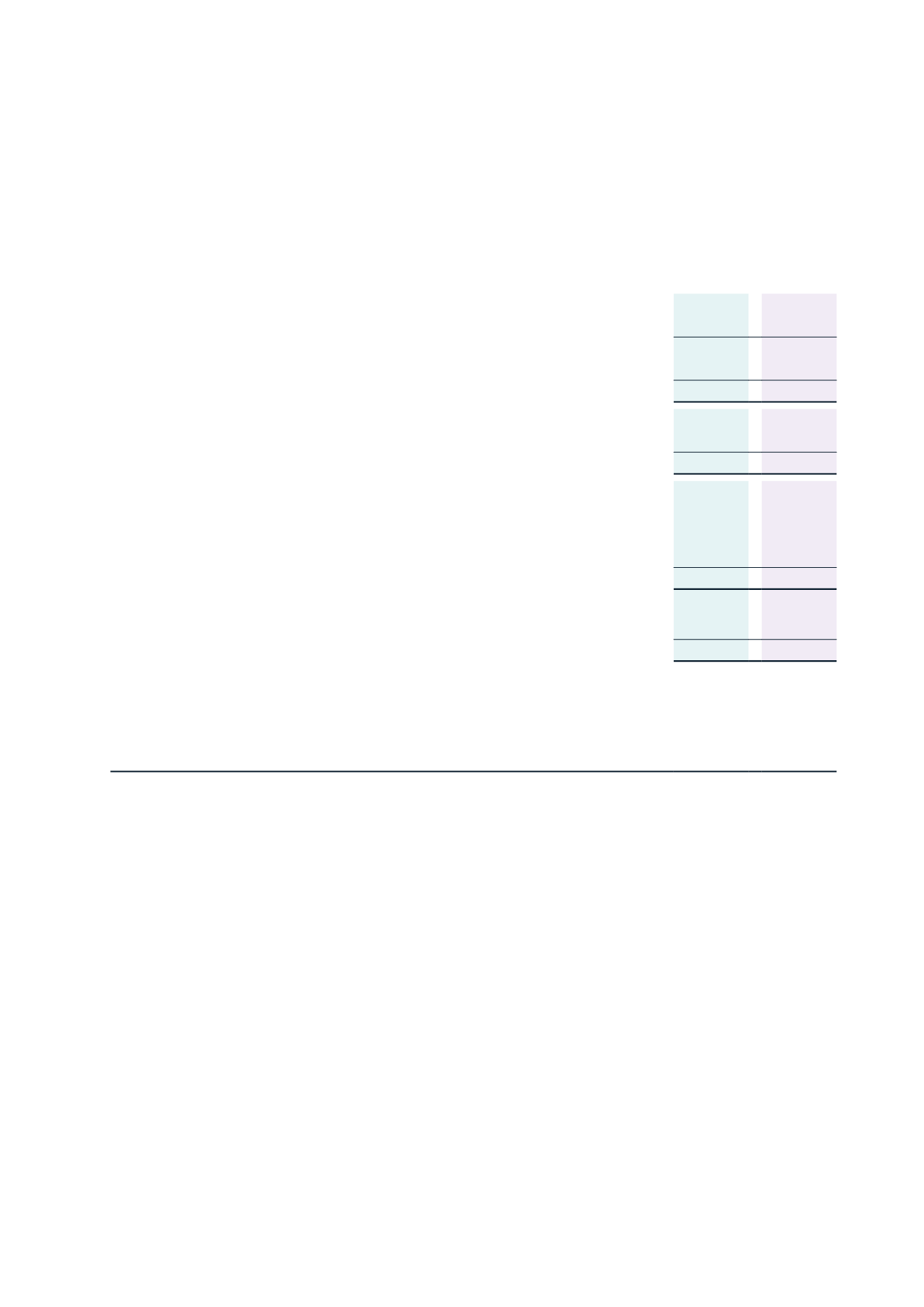

7 INCOME TAX EXPENSE

Consolidated

2016

$'000

2015

$'000

(a) Income tax (expense)/credit

Surplus subject to income tax

-

418

Income tax at 28%

-

117

Deferred tax reversal

12

(3,183)

Income tax (expense)/credit

12

(3,066)

(b) Tax credits available for use in subsequent reporting periods

Māori authority tax credits

106

134

106

134

Movements

Balance at 1 April

134

32

Māori authority credits used

(102)

-

Māori authority credits attached to dividends received

74

102

Balance at 31 March

106

134

(c) Unrecognised deferred tax balances

Unused tax losses

2,000

2,042

Unrecognised deferred tax balances

2,000

2,042

Due to the charitable status of the entities within the Trust the surplus subject to income tax is lower that profit before tax in

Statement of Comprehensive revenue and expense. The taxable members of the Trust have sufficient losses to carry forward

to meet any potential income tax liability. The taxable losses are not recorded in the financial statements due to the lack of

probability that the losses will be recovered.