67

9 TRADE AND OTHER RECEIVABLES

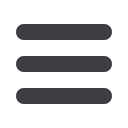

(a) Current - Trade and other receivables

Consolidated

Note

2016

$'000

2015

$'000

Trade receivables

7,584

4,952

Property Settlements

3,008

1,515

Less provision for doubtful receivables

(510)

(350)

Receivables from related parties

13

4,271

4,041

Income tax receivables

1,251

1,023

Prepayments

1,539

1,424

GST

-

483

Other receivables

340

881

17,483

13,969

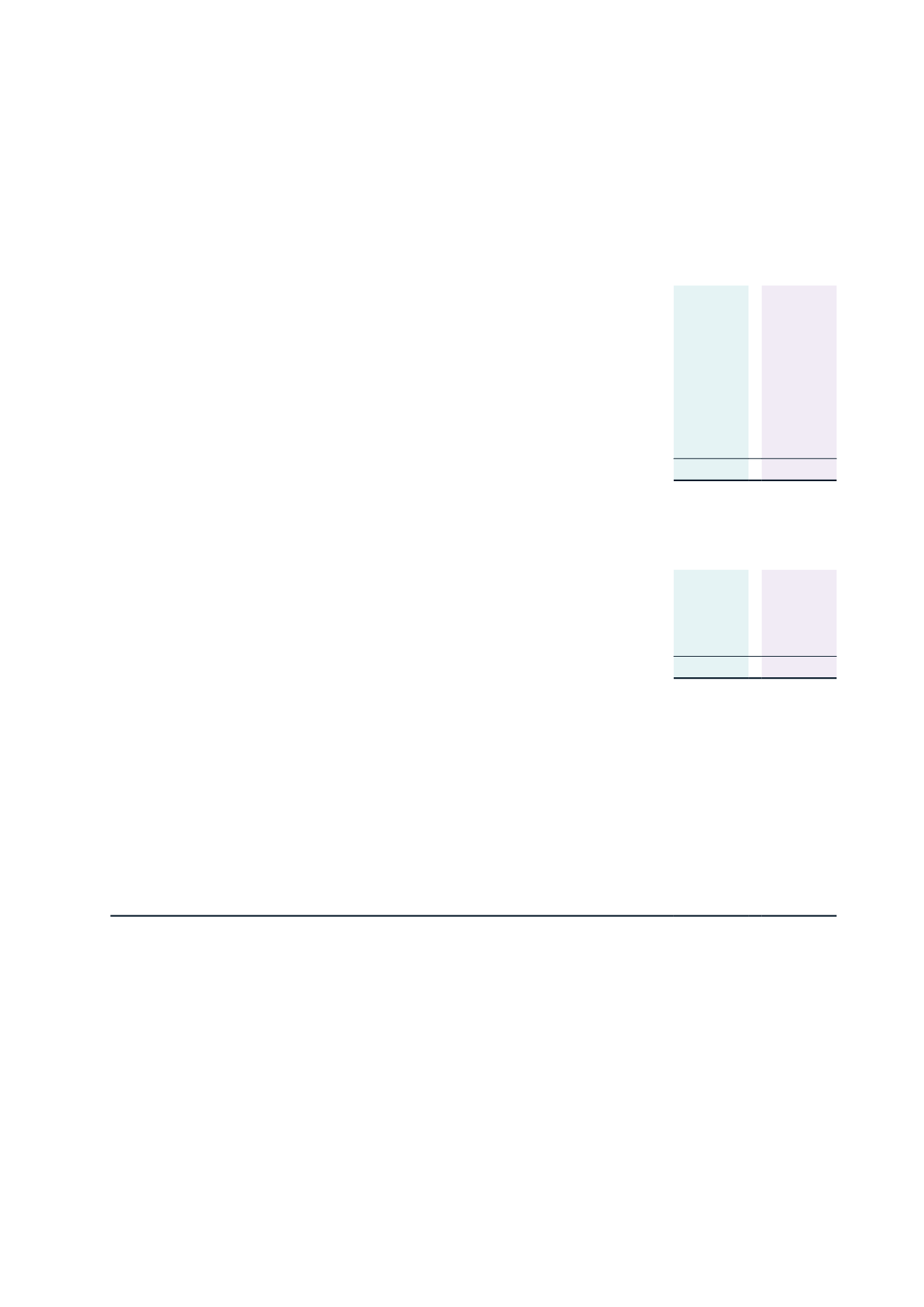

Consolidated

2016

$'000

2015

$'000

Movements in the provision for doubtful receivables are as follows:

Balance at beginning of the year

350

253

Additional provisions

345

281

Provision reversals

(185)

(184)

510

350

Recognition and measurement

Trade receivables are recognised initially at fair value and subsequently measured at amortised cost, less provision for doubtful debts.

Collectability of trade receivables is reviewed on an ongoing basis. Debts which are known to be uncollectible are written off.

A provision for doubtful receivables is established when there is objective evidence that the Trust will not be able to collect all

amounts due according to the original terms of receivables. The amount of the provision is the difference between the asset’s

carrying amount and the present value of estimated future cash flows, discounted at the effective interest rate. The amount of

the provision is recognised in the statement of comprehensive revenue and expense within expenses.

When a trade receivable is uncollectible, it is written off. Subsequent recoveries of amounts previously written off are credited

against other expenses in the statement of comprehensive revenue and expense.