61

(b) Cash generating assets

Cash generating assets are assets held with the primary objective of generating a commercial return. Except for those measured

under the revaluation model or those measured at fair value through surplus or deficit, the Trust assesses non-financial cash

generating assets at each reporting date whether there is any indication that an asset may be impaired. If any such indication

exists, the Trust shall estimate the recoverable amount of the asset. The recoverable amount is the higher of the asset’s value in

use or fair value less costs to sell. Any impairment loss is recognised immediately in the surplus or deficit.

If in a future period, there is an indication that an impairment loss recognised in prior periods may no longer exist or may have

decreased, the Trust will perform an assessment of the recoverable amount of that asset. If the Trust determines that there has

been a change in the estimates used to determine the asset’s recoverable service amount, the assets carrying amount shall be

increased to its recoverable amount and the reversal of the impairment loss recorded directly in surplus or deficit. The reversal is

limited so that the carrying amount does not exceed its recoverable amount, nor exceed the carrying amount that would have

been determined, net of depreciation, had no impairment loss been recognised for the asset in prior years.

(c) Non-cash generating assets

Except for those that are measured under the revaluation model or those measured at fair value through profit or loss, the Trust

assesses non-financial non-cash generating assets at each reporting date whether there is any indication that an asset may be

impaired. If any such indication exists, the Trust shall estimate the recoverable service amount of the asset. The recoverable

service amount is the higher of the asset’s value in use or fair value less costs to sell. Any impairment loss recognised is

recognised immediately in surplus or deficit.

If in a future period, there is an indication that an impairment loss recognised in prior periods may no longer exist or may have

decreased, the Trust will perform an assessment of the recoverable service amount of that asset. If the Trust determines that

there has been a change in the estimates used to determine the asset’s recoverable service amount, the assets carrying amount

shall be increased to its recoverable service amount and the reversal of the impairment loss recorded directly in surplus or

deficit. The reversal is limited so that the carrying amount does not exceed its recoverable service amount, nor exceed the

carrying amount that would have been determined, net of depreciation, had no impairment loss been recognised for the asset

in prior years.

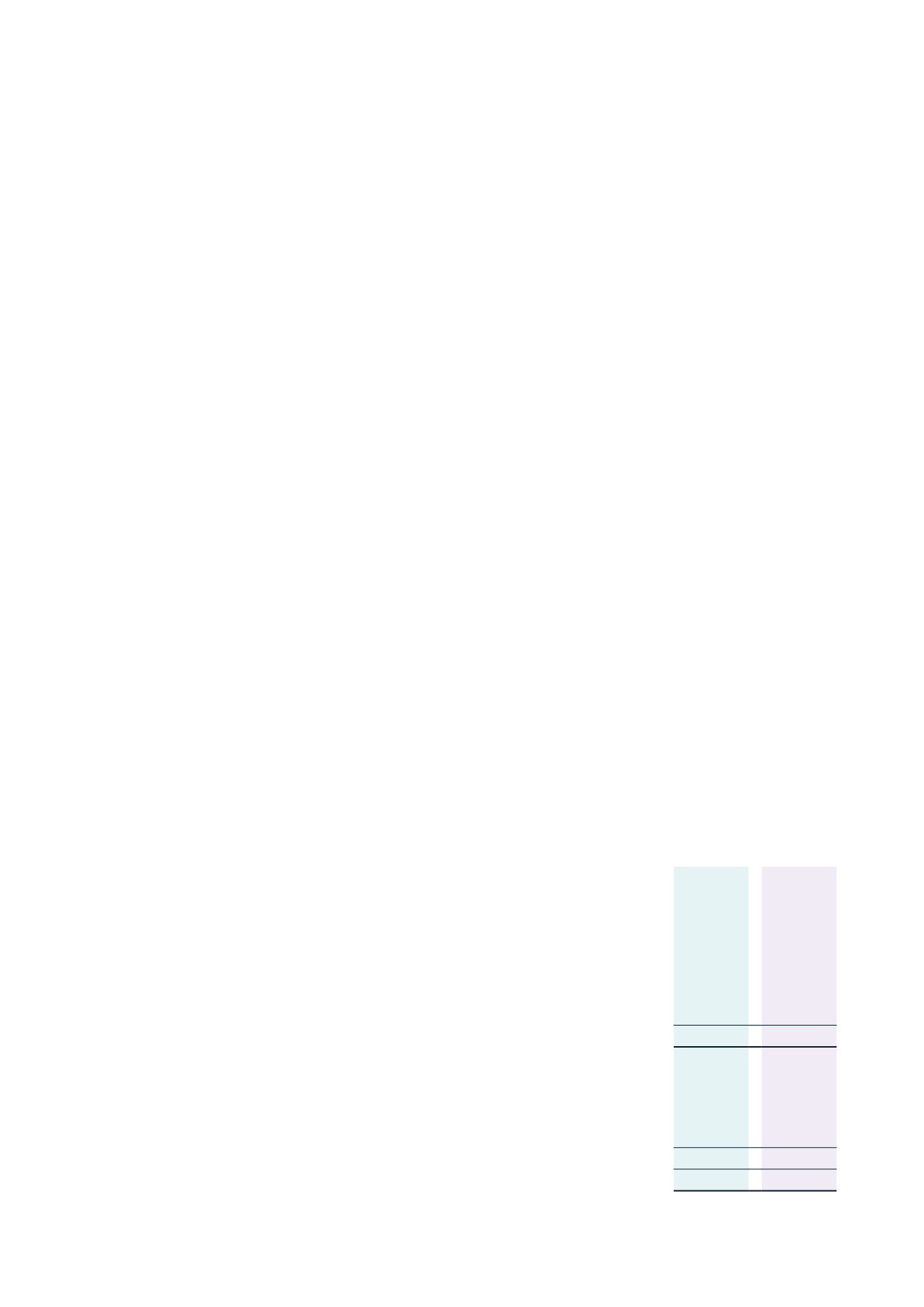

3 TOTAL REVENUE

Consolidated

2016

$'000

2015

$'000

Revenue from operating activities

Rental revenue

35,397

35,247

Amortisation of capitalised lease incentives

(409)

(340)

Hotel revenue

40,894

37,928

Fishing revenue

1,390

1,611

Dairy revenue

725

889

Other revenue

3,610

7,248

Revenue from operating activities

81,607

82,583

Other operating revenue

Other operating gains livestock

210

539

Dividends from unlisted investments

350

481

Dividends from listed investments

949

415

Total operating revenue

1,509

1,435

Total revenue

83,116

84,018