63

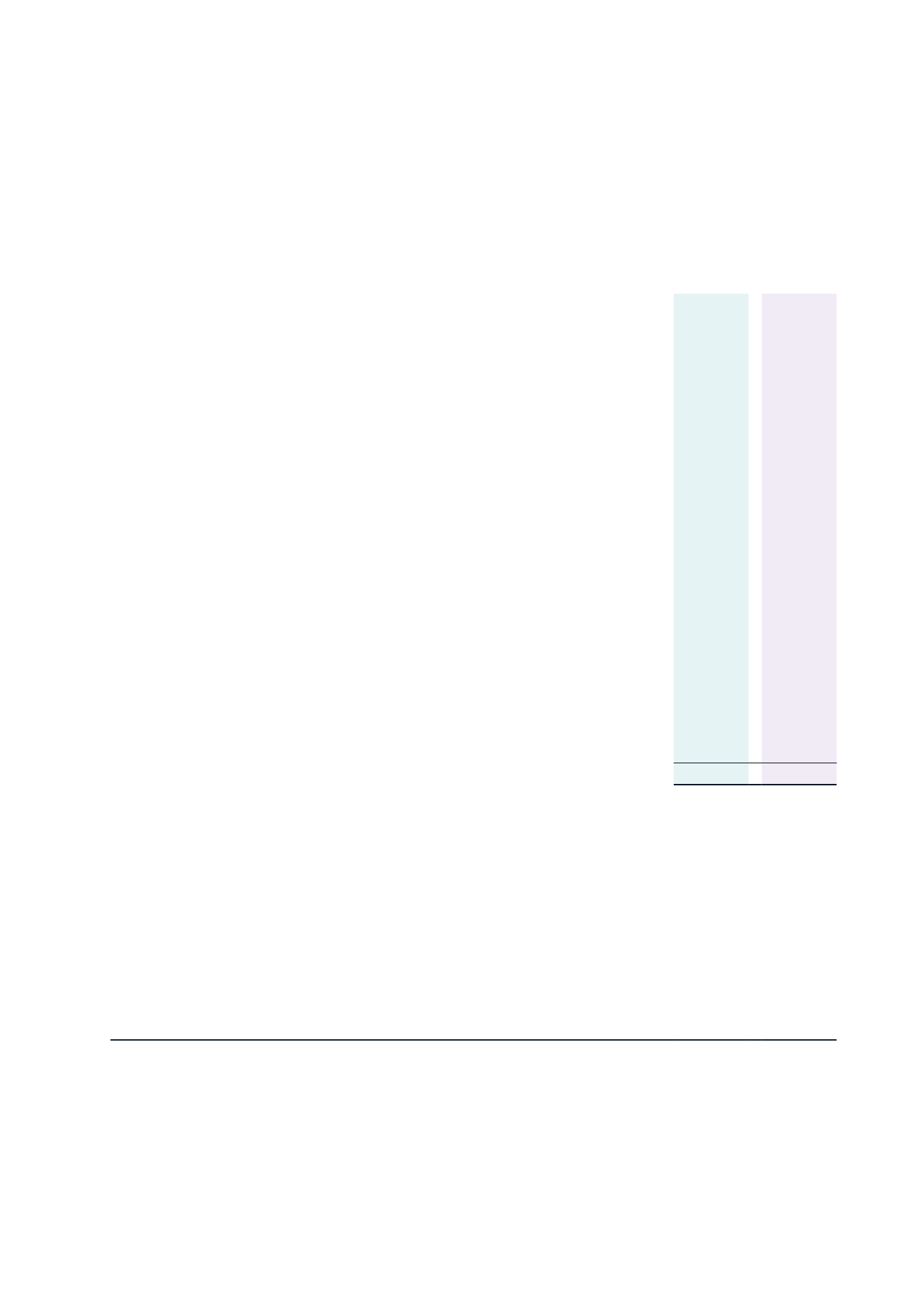

4 EXPENSES

Consolidated

Note

2016

$'000

2015

$'000

Expenses, excluding finance costs, included in the

statement of comprehensive revenue and expense

Employee Benefits

20,207

19,864

Repairs and maintenance

4,680

5,116

Depreciation

16

4,804

4,978

Food expenses (hotels)

3,004

2,881

Consultancy fees

2,735

2,850

Land Cost

-

2,389

Advertising and marketing

1,752

2,334

Rates

2,304

2,049

Management fees (hotels)

242

2,009

Electricity

1,630

1,601

Director and trustee fees

13

1,177

1,129

Operating leases

325

323

Amortisation

15

315

227

Impairment/(impairment reversal)

(30)

185

Other fees paid to auditor

293

174

Audit fees paid to Trust auditors

271

164

Bad Debt Written Off

107

37

Audit fees paid to other auditors

-

25

Doubtful debts and movement in provision

87

(106)

Other expenses

10,716

9,728

54,619

57,957

Other fees paid to the auditor consists of advisory, treasury and taxation services for the Trust.

Recognition and measurement

Employee benefits

Liabilities are recognised for benefits accruing to employees in respect of wages and salaries, annual leave, and sick leave where

it is probable that settlement will be required and they are capable of being measured reliably.

Liabilities in respect of employee benefits expected to be settled within 12 months, are measured at the amount expected to be paid.

The Trust recognises a liability and an expense for bonuses based on a formula that takes into consideration the achievements

of agreed key performance indicators, including the achievement of financial budget targets. The Economic entity recognises a

provision where contractually obliged or where there is a past practice that has created a constructive obligation.