15

This was partly due to strong cash returns from our

hotel and residential property operations, as well as a

good boost from the increasing capital valuations on

property.

At balance date our total debt stood at 27.2 percent

of the total assets. TGH has since paid back a further

$100.5 million of debt, however this took place

following the period covered by this report.

Ngaa Hua Whaanui

Profit from Diverse Areas

It is pleasing how a range of the tribe’s investments

have contributed to the result over the past year.

Property investments recording underlying increases in

value, hotels returned good puutea, residential sections

sold well and new contracts were won by Go Bus.

Waikato Milking Systems has increased export sales to

balance the effect of a tough local market due to lower

milk prices. Shares owned in Genesis Energy were an

exception to an otherwise positive year, with the value

of the shares dipping by 8.5 percent by year’s end.

Ngaa Whakatau Tahua Ki Mua

Investment Decisions Ahead

TGH has many positive investment opportunities

ahead as we move toward a more diversified portfolio

in line with our role as Kaitiaki (guardian) of the

tribe’s commercial investments. The opportunities

in front of us include investing into shares to help

reduce risk, improve liquidity and move us to a more

balanced portfolio. Further possible developments or

acquisitions (depending on the availability of capital)

include the purchase of whenua, another hotel in

Taamaki Makaurau, Ruakura Inland Port, and exploring

future opportunities for developments on tribal

whenua at Huntly and Meremere.

TGH will be able to

secure more puutea, more

jobs and more whenua

for Waikato-Tainui by

holding a wider spread

of investments.

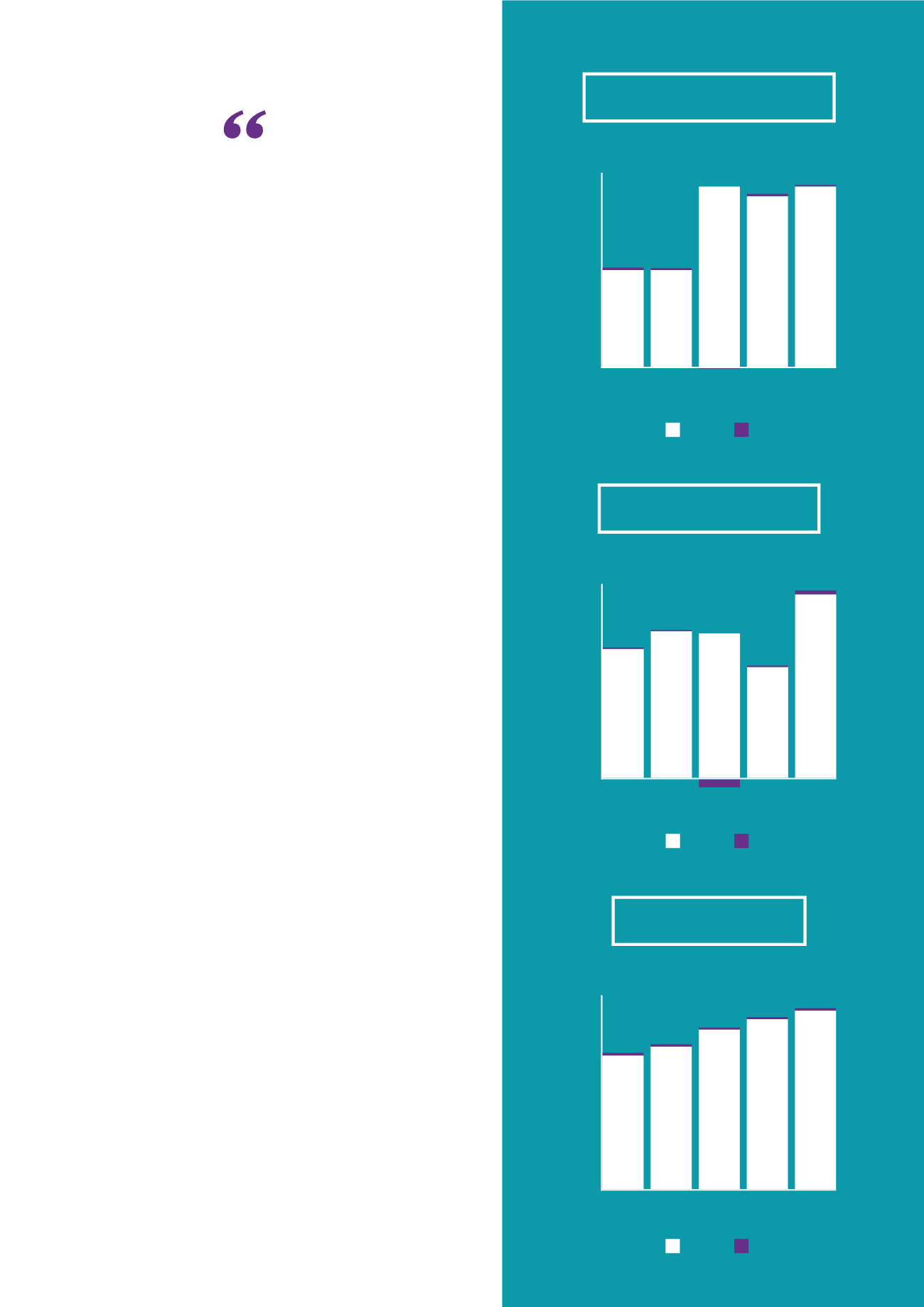

NET OPERATING PROFIT — TGH + WTF

0

5

15

20

25

2012 2013 2014 2015 2016

10

35

40

$M

TGH WTF

20 20

37

37

35

0.5 0.4

0.5

0.3

(0)

YEAR

NET PROFIT/(LOSS) — TGH + WTF

0

20

30

40

2012 2013 2014 2015 2016

10

50

60

$M

TGH WTF

39

45

44

34

56

0.5

0.4

1.2

0.5

(2.4)

YEAR

TOTAL ASSETS — TGH + WTF

0

200

400

600

800

1000

$M

2012 2013 2014 2015 2016

TGH WTF

14

13

11

11

12

680 725

812

865

909

YEAR