27

TRUST WA I KATO

ANNUAL REPORT

2 0 1 4

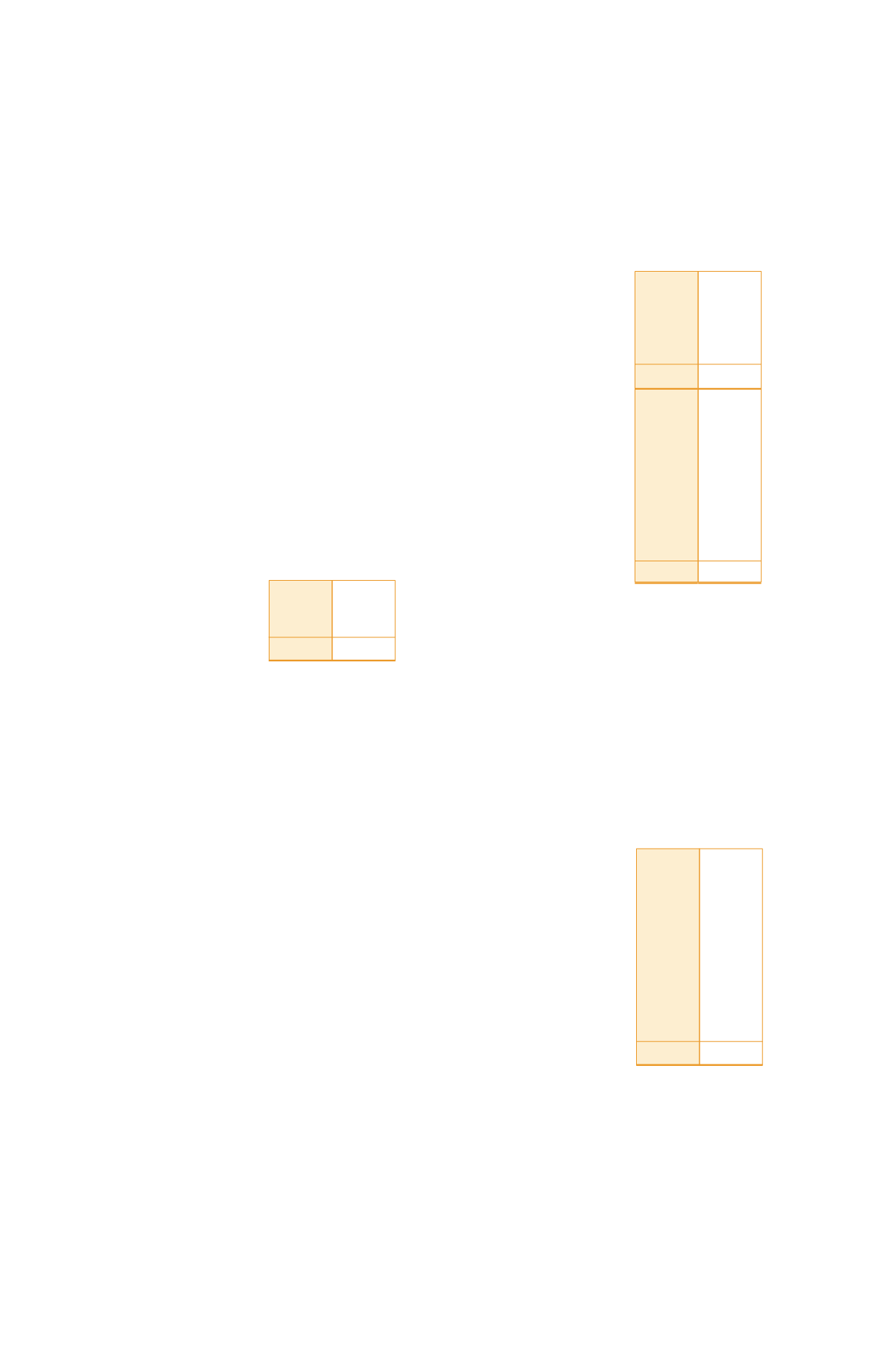

7. Donations Payable

2014

2013

NZ$’000

NZ$’000

Donations Payable

1,605

1,600

1,605

1,600

Donations payable are discretionary donations

where there are no significant conditions

attached or where the significant conditions

attached to the donations have been met at

balance date.

8. Contingent Liabilities: Donations And

Sponsorships

Donations that are classified as contingent

liabilities at balance date are discretionary

donation obligations that are reliant on

fulfilment of certain conditions in future

years. Sponsorships that are classified as

contingent liabilities at balance date are

sponsorship contracts which are reliant on

fulfilment of certain conditions in future years.

The following contingent liabilities exist for

donations and sponsorships that have been

approved in the current or previous years.

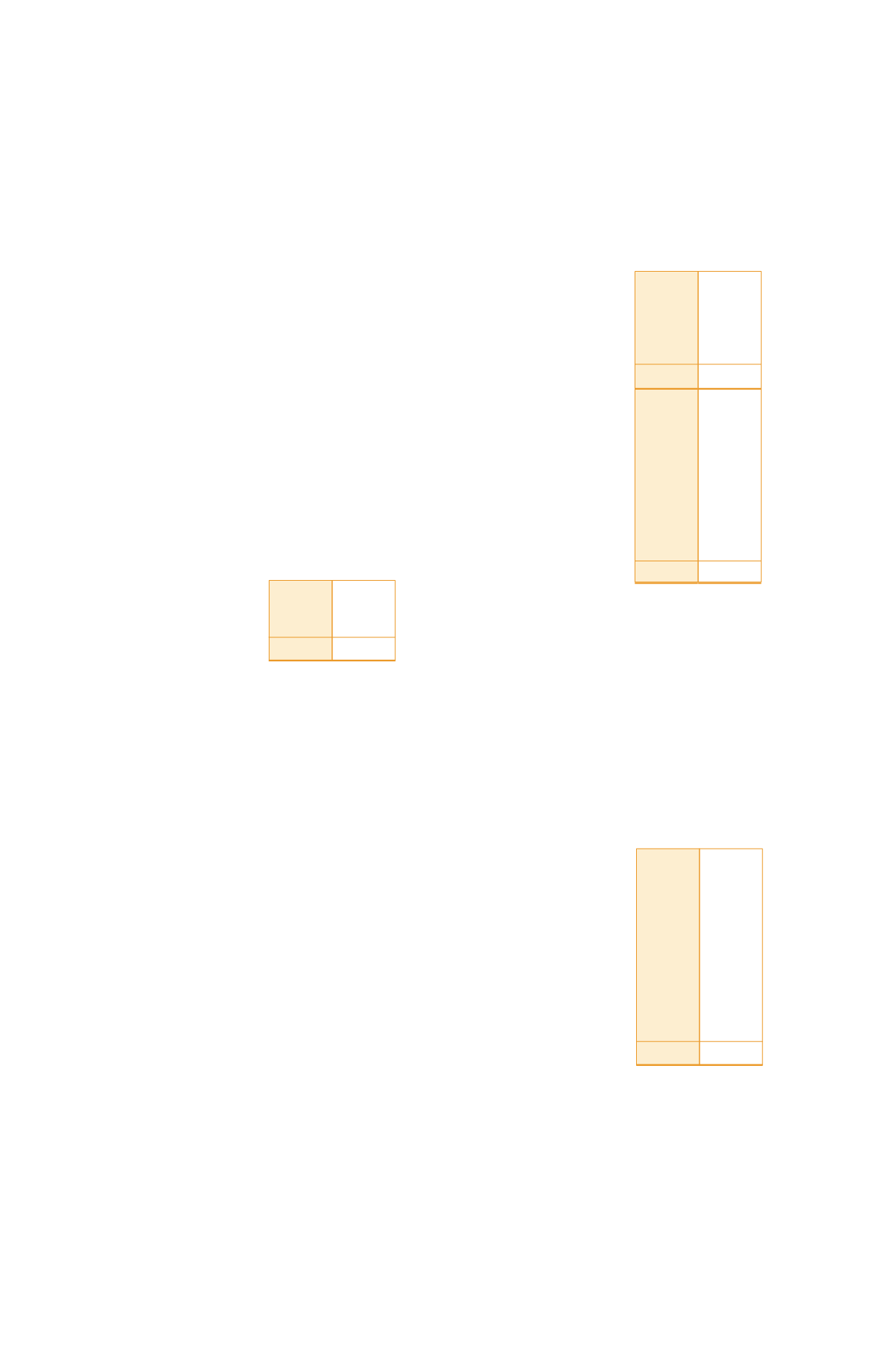

9. Sport Waikato Loan

The loan to Sport Waikato was secured by

a first ranking General Security Agreement

(GSA) in favour of the Trust over all of Sport

Waikato’s present and after-acquired property,

with a first priority amount of no less than

$2,000,000 and by a first mortgage over Sport

Waikato’s leasehold estate and interest in

their site at Wintec. The loan was interest free

and repaid in full on 19 August 2013. The loan

balance was made up as follows:

2014

2013

NZ$’000

NZ$’000

Donations

4,335

5,217

Sponsorships

200

295

4,535

5,512

Subject to fulfilment of the

conditions, the contingent

liabilities are payable

as follows:

Not later than 1 year

3,790

3,315

Later than 1 year and

not later than 5 years

745

2,197

4,535

5,512

The Trustees have adopted an investment

strategy with a targeted long term annual

rate of return of 6.6% (2013: 7.1%) of the Trust

portfolio value. Recognising that actual returns

are likely to fluctuate from year to year, the

Trust retains the variation from the target in

an Investment Fluctuation Reserve, so that in

years when investment returns are less than

the target, sufficient funds are available to

meet expenditure and make donations. If the

Trust fund falls below the value that needs to

be maintained for the benefit of current and

future generations the levels of expenditure

and donations are reviewed by the Trust.

2014

2013

NZ$’000

NZ$’000

Loan Principal

1,500

1,500

Fair Value Adjustment

on Initial Recognition of

Interest Free Loan

(525)

(525)

Cumulative Notional

Interest

525

476

Repaid

(1,500)

-

-

1,451